Chinese iron ore demand hinges on China’s construction growth, restocking in Q2

Time:Thu, 25 Apr 2024 09:26:57 +0800

keywords :

This report is part of the S&P Global Commodity Insights’ Metals Trade Review series, where we dig through datasets and digest some of the key trends in iron ore, metallurgical coal , copper , alumina , cobalt , lithium , nickel and steel and scrap . We also explore what the next few months could bring, from supply and demand shifts, to new arbitrages, and to quality spread fluctuations.

The Asian iron ore market is bracing for an uncertain second quarter, with spot prices for seaborne material plunging to an 11-month low and recovery hinging on a pickup in construction activity in China and restocking demand.

Market participants are concerned about weakening raw material prices through the year if steel values fail to pick up in Q2.

However, a seasonal upturn of iron ore remains uncertain, as prices do not have much scope to rebound, according to analysts at S&P Global Commodity Insights.

S&P Global Commodity Insights analysts forecast the Platts 62% Fe iron ore index, or IODEX, to average $110/mt CFR China in 2024 and $115/mt CFR China in Q2, while the IODEX averaged $119.75/dmt CFR China in 2023.

Volatility throughout the quarter

A spate of macroeconomic events over the past quarter has contributed to price volatility, both in the iron ore physical and futures markets, market participants noted.

Seaborne iron ore prices were largely rangebound throughout the first quarter, averaging $118.4/dmt CFR China. January saw the Platts 62% Fe iron ore index, or IODEX, at its strongest at $143.95/dmt, before a continuous downtrend falling 29% to a 10-month low at $102.2/dmt by March 15.

The market gained some momentum in January and early February amid expectations of a strong restocking demand post Lunar New Year and news of increasing financial liquidity in Q1, and likely stronger gains in manufacturing steel demand.

China’s iron ore port stocks also climbed 15% on the quarter to a 13-month high of around 142 million mt end-March, according to S&P Global analysts.

Outlook in the earlier half of Q1 fell flat without demand picking up in the downstream steel markets as construction activity failed to restart as quickly as expected, leading to overstocked steel and iron ore inventory in mills, market participants said.

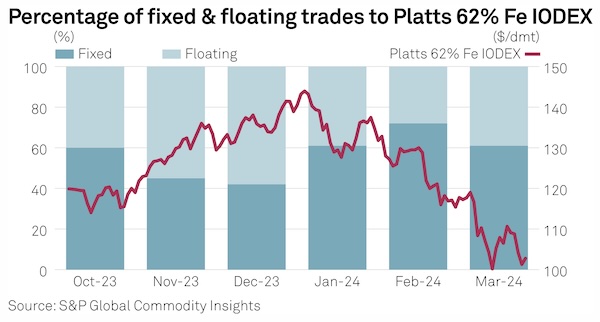

With the emergence of the high prices in H1 Q1 and a continuous downtrend, S&P Global saw more spot seaborne trades on a fixed-price basis as market participants sought to hedge for better prices.

S&P Global observed 49% of spot trades concluding on fixed-price basis in Q4 2023 as compared to 64% in Q1 2024, while 51% of trades concluded on a floating basis against 36% over the same period.

Q1 saw a shift in pricing preference toward fixed-priced trades, which market sources attribute to lower iron ore prices, particularly in February when buyers felt levels had bottomed out and sellers had little optimism for a market rebound in Q1.

India to focus on domestic markets

Indian low-grade fines also saw a resurgence on the iron ore market in H1 Q1, but Indian fines producers would likely shift their focus to the domestic market as they are finding a better deal within, sources said.

Tradable levels for the Indian low-grade fines were heard at a 12% discount against the Platts IODEX in late January and early February as mill margins drew focus to lower grade products.

However, the low-grade market became bearish as iron ore prices failed to pick up by March and Indian fines tradable levels were heard falling to December levels, ranging at discounts of 18%-19% against the Platts IODEX.

Downstream steel HRC and rebar margins have also recovered through Q1, indicating more profitability for mills in seeking higher iron content fines, further dampening interests for low grade cargoes such as Indian Fines.

BHP ramps up spot trading volumes

In light of the bearish low grade market, medium grade fines would make more economical sense as the sintering feedstock during a period of steel margin recovery, market sources said.

Despite Australia’s Pilbara region recovering from a cyclone in February, S&P Global observed that the total reported Q1 trade volumes of BHP and Vale increased on the quarter, while the reported trade volumes of Rio Tinto’s Pilbara Blend Fines (PBF) remained largely stable across the quarters.

Among the IODEX basket of brands, S&P Global observed BHP’s Newman High Grade Fines (NHGF) spot trading volume had the largest quarter-on-quarter and year-on-year rise.

Lump premiums plunge despite winter sintering

The outlook for lump demand remains depressed for Q2 as the winter environmental measures conclude in the spring season.

Thin margins for steel production and a softening demand in the downstream sector influenced lump premiums to tumble to a near 20-month low in Q1.

Meanwhile, the rainy season in southern China in Q2 might increase the moisture level of lump and the associated cost of screening, which makes lump a less preferable, China portside sources said.

Q1 is traditionally the peak season in China for lump demand due to winter environmental regulations, but amid less stringent winter sintering restrictions this year, steel mills maintained lower proportions of direct feedstocks.

Seaborne lump premiums fell 70.02% from the beginning of 2024 to 6.1 cents/dmtu March 28, S&P Global data showed.

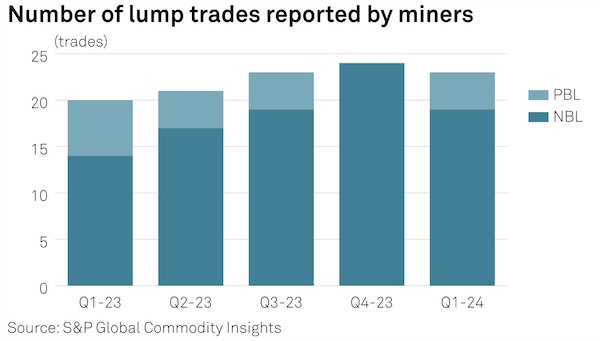

Among the 23 spot transactions for mainstream lump cargoes from BHP and Rio Tinto in Q1 2024 — a 4% on-the-quarter fall — BHP’s sales of 19 cargoes of Newman Blend Lump saw a 36% rise on the quarter, S&P Global data showed.

Therefore, despite slow demand, a firm supply of has contributed to an accumulation of lump inventories at portside, underscoring a market dynamic of strong supply and weak demand.

Source: Platts