Top lithium stories of 2021 and what to expect in 2022

Time:Tue, 28 Dec 2021 06:12:08 +0800

keywords :

Lithium prices skyrocketed in 2021, with a benchmark index more than doubling and key prices in China hitting records. Driving the frenzy was and is the metal’s role in transitioning the world towards a greener economy, as it is a key component for the rechargeable batteries used to power electric vehicles.

Limited supply not only helped prices, but pushed companies moving to meet demand, which made lithium take centre stage in our news coverage.

#1 Jadar

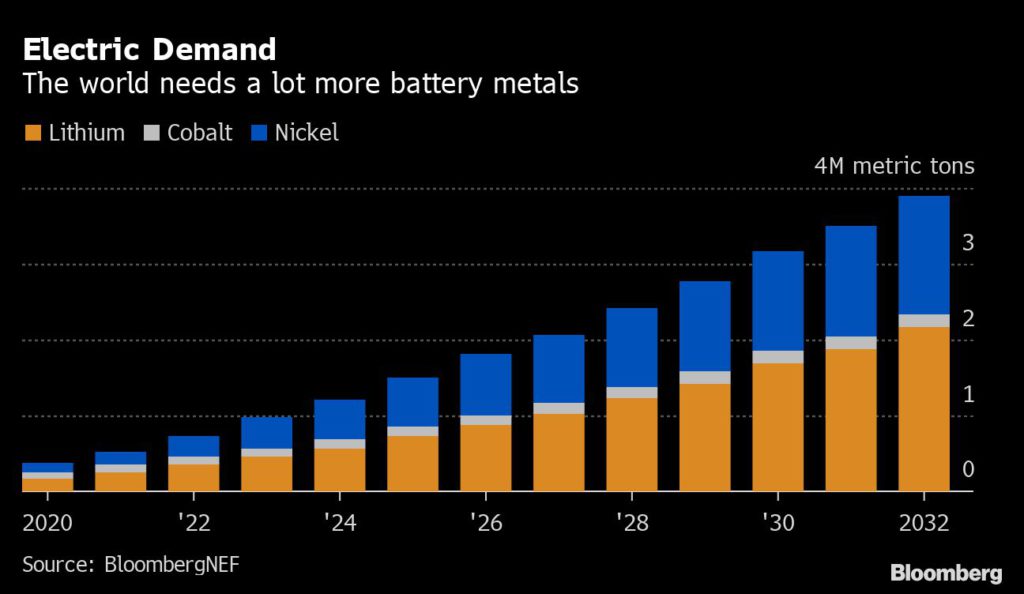

Rio Tinto (ASX, LON, NYSE: RIO) greenlighted in July its $2.4 billion Jadar lithium project in Serbia. The world’s second-largest miner said at the time that by 2030 EV makers will need about three million tonnes of lithium, compared with the roughly 350,000 tonnes they consume today.

Existing operations and projects combined, however, are slated to contribute one million tonnes of lithium.

Filling that supply gap, Rio Tinto said, would require more than 60 Jadar projects. The proposed mine is slated to produce 58,000 tonnes of lithium carbonate, 160,000 tonnes of boric acid and 255,000 tonnes of sodium sulphate a year at full tilt.

But the company is facing fierce opposition to the project. In early December, local opponents organized a movement that has rocked the government and brought cities to a standstill as thousands of protesters marched in the streets. Authorities subsequently suspended a land-use plan for the proposed mine, though they didn’t reject the project completely.

Rio said on Dec. 23 it plans to pause its Jadar lithium project after a municipality in the country scrapped a plan to allocate land for the mine, during which it will engage in a public dialogue about the project.

#2 Chinese offensive

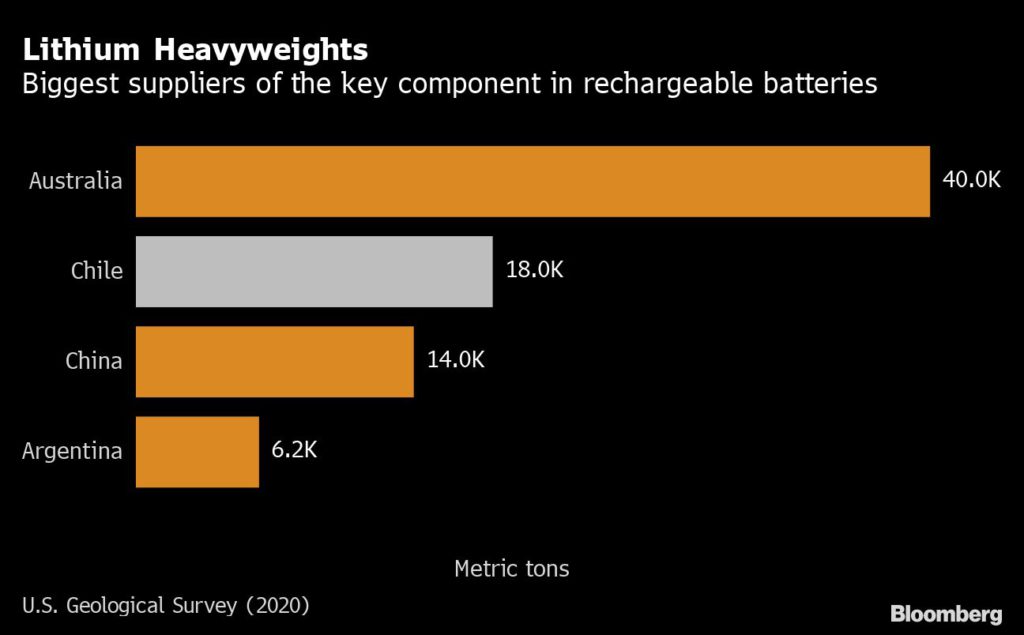

Even though China’s lithium reserves rank as the world’s fourth-largest, the battery metal is mainly found in the salt lakes around Tibet and Qinghai, a sparsely populated Chinese province spread across the high-altitude Tibetan plateau. That makes it difficult to refine and transport, and partly explains why Beijing looked elsewhere this year.

Ganfeng Lithium, one of the world’s top producers, bid for a stake in Canada’s Millennial Lithium in July, while battery making giant CATL, led by billionaire Zeng Yuqun, joined the race a few months later, trumping Ganfeng. In the end, it was a third company, Lithium Americas, that emerged victorious.

The company also acquired Mexico-focused explorer and developer Bacanora Lithium (LON: BCN) this year, adding the Sonora project to its growing portfolio.

Ganfeng didn’t stop there and bought in September International Lithium, which was its partner in the Mariana project in Argentina, one of the biggest deposits globally.

Representatives of five Chinese companies obtained special visas and travelled to Afghanistan in early November to conduct on-site inspections of potential lithium projects.

Zijin Mining also grabbed headlines, especially with the acquisition of Canada’s Neo Lithium Corp in October.

#3 Aussie M&As

One of the biggest stories of the year in the lithium market came in April, with Australian lithium miners Galaxy Resources (ASX: GXY) and Orocobre (ASX: ORE) announcing their merger. The business combination created a $3.1 billion (A$4bn) company, set to be the world’s fifth-largest producer of lithium chemicals.

A joint venture between Tianqi Lithium and IGO Ltd also grabbed headlines as they produced Australia’s first batch of lithium hydroxide, used to make cathodes for lithium-ion batteries that power electric vehicles. Once in full production, Kwinana will be the largest lithium hydroxide-producing operation and the biggest spodumene converter in the world.

Piedmont Lithium (ASX: PLL) and its 19%-owned Sayona Mining (ASX: SYA) completed the acquisition of Canada’s North American Lithium (NAL), as part of their plan to create a potential lithium production hub in the Abitibi region of Quebec.

Weeks later, they bought another Canadian project: Moblan project in the Eeyou-Istchee James Bay region of northern Quebec.

Liontown Resources (ASX: LTR) confirmed plans in November to bring its Kathleen Valley hard rock project in Western Australia into production, a year earlier than originally targeted as it released a definitive feasibility study.

Pilbara Minerals (ASX: PLS), one of Australia’s top lithium miners, closed the year by slashing its forecast for shipments due to a raft of issues — from delays in commissioning and ramping up more processing capacity, to unplanned shutdowns and skilled worker shortages.

#4 Chile fighting back

Chile, which lost the crown as the world’s largest lithium producer to Australia in 2018, began staging a comeback. It opened in October a tender for the exploration and production of 400,000 tonnes of lithium.

In only a couple of weeks, 57 companies showed interest in new contracts, according to official figures.

Albemarle (NYSE: ALB) and SQM (NYSE: SQM), the world’s no. 1 and 2 lithium miners respectively, already have operations in Chile’s north, which they plan to expand.

SQM targets to reach a total capacity of 180,000 tonnes annually next year, with total production expected to achieve 140,000 tonnes. These represent increases of roughly 60,000 t/year and 40,000 t, respectively, from 2021.

Next: 2018 déjà vu?

The rush to meet lithium demand could see a repeat of 2018 when a glut saw the lithium price crash, analysts predict.

While miners are scurrying to expand capacity, they can’t keep up with demand, so market tightness is likely to persist in the near term, they say.

Fitch Solutions goes even further, predicting increasingly large deficits out to 2030 that could “deeply” alter the market’s dynamics.

“Lithium supply will face a number of vulnerabilities, including geographical concentration at both the mining and refining level, as well as the limited presence of established and large mining players, which pose risks to the project pipeline execution,” the consultancy said in a December note. “Rising resource nationalism in key lithium markets could also hamper the development of new projects.”

Pilbara Minerals (ASX: PLS), one of Australia’s top lithium miners, closed the year slashing its forecast for shipments, which has further exacerbated tight supply for the key battery metal.

Some industry actors fear that climbing lithium prices could end up raising costs for batteries and electric vehicles, hampering the consumption of clean-energy sources at a time the world urgently needs them.

Experts at UBS project that by 2030 the world will need to produce 2,700 GWh of lithium-ion batteries annually to supply the EV industry. That is 13 times the amount of battery power used now, or “225 billion iPhone 11 batteries.”

Most existing suppliers are planning expansions. Albemarle’s MARBL joint venture with Minerals Resources in Western Australia recently unveiled plans to restart one of the Wodgina mine’s three 250,000 mt/year processing lines in Q3 2022.

Livent (NYSE: LTHM) plans to add 5,000 mt of lithium hydroxide capacity in the US by Q3 2022. It is also adding an initial 10,000 mt lithium carbonate in Argentina, although this is only due to reach commercial production in the first quarter of 2023, with another 10,000 mt to be added in the second phase by the end of 2023.

New projects should also start up in 2022, including Lithium Americas’ 40,000 tonnes/year carbonate Caucharí-Olaroz project in Argentina and Sigma Lithium’s 330,000 t/year spodumene project in Brazil.

Lithium Americas is also developing the Thacker Pass lithium mine in Nevada, though that project has faced legal setbacks. The company is expected to publish a definitive feasibility study on Thacker Pass next year.

New techs, zero-carbon and national security

The ongoing development of new lithium extraction techniques could boost primary supply of lithium. The upcoming development of lithium recycling and uncertainties around its timeline could also surprise the upside supply expectations, experts agree.

We can also expect new actors to strengthen their position in the market, particularly European ones.

The European Commission added lithium to its list of critical raw materials for the first time in 2020, signifying its shift to the forefront of attention.

Portugal is currently the continent’s largest lithium producer, accounting for 1.6% of global production in 2019, however the country’s lithium is not marketed to the auto sector, but to ceramics and glassware makers.

Savannah Resources (AIM: SAV) is forging ahead with its Mina do Barroso proposed lithium mine in Portugal and it plans to soon publish a definitive feasibility study for the project.

Erris Resources (LON: ERIS) is working on the Zinnwald project, in Germany, located in the heart of Europe’s chemical and car industries.

Vulcan Energy Resources (ASX: VUL), backed in part by Australian investor Gina Rinehart’s Hancock Prospecting, is aiming to produce the world’s first “zero-carbon lithium” from what it considers to be Europe’s largest lithium resource in the Upper Rhine Valley of Germany.

The company has in recent weeks signed lithium supply agreements with several European automakers, including Volkswagen, Stellantis and Renault. It aims to start commercially producing lithium by 2024.

An International Energy Agency (IEA) report published in May recommended governments to start stockpiling battery metals, noting that lithium demand could increase 40-fold in the next 20 years. IEA executive director Fatih Birol said this would become an “energy security” issue.

(With files from Reuters and Bloomberg)